How Do Betting Odds

- Betting odds represent the probability of an event to happen and therefore enable you to work out how much money you will win if your bet wins. As an example, with odds of 4/1, for every £1 you bet, you will win £4. There is a 20% chance of this happening, calculated by 1 / (4 + 1) = 0.20.

- Using the following simple formula: Stake x Decimal Odds = Total Payout. Another way of thinking about these numbers is that they represent how much a winning ticket will be worth if you bet $1. In order to spot the underdog and favorite, just keep in mind that. The lower the number, the more favored.

- Making a $10 winning bet on an NBA game priced at 5/1, would net you $60 in total. You can use the following formula to calculate potential returns with fractional odds: ( (Stake/ denominator) x numerator) + stake = return. For example: (10 x 5) + 10 = 60.

Kansas City Chiefs (-250), Las Vegas Golden Knights (-110), Toronto Raptors (+125) – the chances are that you’ve come across these sorts of options in your sports betting journey. If you don’t know what these numbers mean, you’re not the only one.

A large number of betting newbies have no idea what the figures are representing. If you want to learn, you’re at the right place. We’re now going to show you how Vegas odds work. We will also explain the process of making the odds. We’re even going to show you how to use this knowledge to your advantage.

What Are Vegas Odds?

How do betting odds work in MMA? MMA is a progressive sport that has become quite popular in the gambling industry. Punters bet on different competitions held from time to time. As you look at the different MMA tournaments that you can bet on, you will come across odds. Fractional odds allow you to calculate how much money you will win on your bet in comparison to you stake. The number on the left (e.g. 10) is how much you will win. The number on the right is how much you need to stake. For every £/€1 you bet, you will win £/€9.

Vegas odds a.k.a. American-style odds are the ones you will see in the land-based sportsbooks across Nevada. Caesars, Wynn, Golden Nugget – all these bookies are using the Vegas odds format.

The trouble is that they may seem strange to the inexperienced eye. However, everything becomes clear once you learn more about them. So, how do Vegas odds work?

These odds come in the form of three-digit numbers, which can either be positive or negative. If the number is negative, it means that the team is the favorite. If it’s a positive number, it’s the opposite. If the number on each potential outcome is -110 (or sometimes -105), it means that each team has an equal chance of winning.

The big question is how can you use these odds to figure out how much money you’re going to cash in if your bet wins? That’s the question we’re going to answer next.

How You Calculate Vegas Odds?

You calculate your potential win based on whether the odds come as a positive or a negative number. If the odds are positive, e.g., +150, it practically means that this is how much you can profit if you bet $100.

Let’s say you want to bet Justin Gaethje at Vegas odds of +150. If you put, $100, you’re going to make a net profit of $150 if he wins. But, what if you’d like to bet a different amount?

In that case, you need to use the following formula:

Vegas Odds/100 x Your Stake

So, let’s say you wish to put $70 on Gaethje, your potential net profit is calculated by dividing his odds by 100, then multiplying the number with 70.

Use your calculator and you will see that 150/100 x 70 equals 105. That is how much you will make if Gaethje wins. Note that $105 is your net profit, while you’ll also get your $70 stake back. So, your total win would be $175 on a $70 bet.

An important thing to remember is that the aforementioned formula only works if odds are displayed as positive numbers. If the number is negative (e.g., -150), you need to go with a different formula. In that case, this is what you got to use:

Your Stake/Vegas Odds x 100

This is because, with Vegas odds, the negative number represents the amount of money you need to bet in order to win $100. So, if the odds are -150, you will have to bet $150 to get a net profit of $100.

Is There a Simpler Alternative?

Vegas odds are traditionally used in land-based sportsbooks across Nevada. It’s been like that for decades, and when online sports betting became legal in other US states, most operators decided to embrace this format.

The same was the case with offshore sportsbooks that cater to American customers, with one important difference – BetOnline.ag, MyBookie.ag, SportsBetting.ag, and many other bookies let the players decide on the odds format.

So, if you find Vegas odds too complicated, you can always use decimal odds in offshore sportsbooks. How they work is that your stake is multiplied by the odds. The result you get is your gross profit (your net profit + your stake). For example, if the odds on Tampa Bay Buccaneers are 1.65 and you wish to bet $90, your potential win is $148.5.

Who Sets the Odds in Vegas?

When speaking about Vegas odds, there’s another question that pops out – who decides them? Some sportsbooks employ teams of oddsmakers to come up with the odds, while some hire independent companies to do the work for them.

In both cases, the goal is to set the odds in such a way that they attract equal action on both outcomes. This way, the sportsbook is going to make profits regardless of the outcome. As a result, the Vegas odds on the favorite are always negative numbers, while underdogs get positive numbers.

Oddsmakers take into account various factors to decide who’s the favorite/underdog. What we’re talking about are power rankings, game locations, the form of the teams, and so on. However, this doesn’t necessarily mean that Vegas odds equal the true probability.

Using the Odds Knowledge to Your Benefit

The thing about odds is that they change all the time. For example, there might be some big news coming from a team’s roster, such as an injury of a key player. You can be sure that the sportsbooks will adjust the odds in that case in order to protect themselves.

Still, the #1 reason why odds change lies in the behavior of the bettors. If the players suddenly start betting on one outcome, the sportsbook will have to react by adjusting the odds. They will move the odds on the outcome in question (e.g., from -128 to -175), while moving the odds against the opposite outcome (e.g., from +108 to +155).

This way, they are making sure they aren’t going to have to pay out too much money if the favorite wins. At the same time, they are encouraging bettors to put their money on the underdog with the odds more lucrative than earlier.

How can you use this knowledge to your benefit? You can go on an odds hunt. If you compare all the odds available, you will be able to find the best value for your bets. It may be at a Vegas-based sportsbook or it could be at an offshore website, you’ll find out only after you’ve compared them!

The evolution of exchange betting has revolutionised market-making to such a degree that even the biggest bookmaker names no longer employ professional odds setters.

How did odds making start?

As touched on in our Brief History of Betting blog, the concept of calculating the likely chance of a winner in a horse race, and converting that into bookmaker odds, was devised by one Harry Ogden.

Operating on Newmarket Heath towards the end of the 18th century, Ogden was the first bookmaker to take betting beyond its strikingly crude roots. Most early bets were simply a way of settling an argument over whether a named event would come to pass or not.

Not only did Ogden begin the process of making a book, he also understood that he had to save a percentage of his takings for his own purse. In order to achieve this, he slightly adjusted prices in his favour. It worked: if somebody won a bet and got paid out at odds of 4/1 they were unlikely to complain, especially at this early stage, that they had not been paid at the true probability of 5/1.

So already, within Ogden’s lifetime we witnessed the evolution of a book featuring a range of prices as well as the concept of what is now known as an “overround”.

What is an overround book?

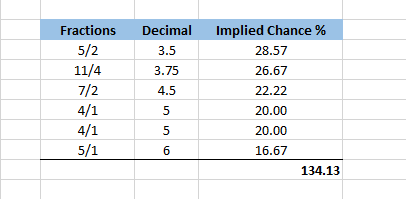

A perfect book, without factoring in a margin for the bookie, would mean the implied probability of all outcomes would add up to 100%. However, bookies use the concept of overround to stretch this probability greater than 100% – which then becomes their profit.

Here’s an overround example from a tennis match:

Now, have you ever considered why bookmakers like to encourage accumulators in sports like football where punters enjoy backing multiple selections in a single bet?

Well it’s simple: if a bookmaker has an overround of 105% on each of five football matches, a punter placing a bet in all five of those matches is betting against an overround 125% because the extra 5% is factored in each time.

The growth of betting and odds compiling

By the 1950s the big firms that covered the length and breadth of the country betting on horses and greyhounds were already employing odds-makers to help them compile what was known as the “tissue” for each race.

This was effectively the first show of prices. Bookmakers would certainly collude to some degree to check their assessments of the market were not wildly out of place but by and large they were happy to trust their instincts.

The prices were not static: they moved to respond to market forces after the first show was published on the boards.

What did a bookie do if he felt liabilities were in danger of getting too big on a particular horse? All he had to do was rub off the displayed price on his chalkboard and put up a less attractive price. He might then balance his book by pushing out the prices of less fancied runners.

The advent of legal betting shops

The golden age of betting was triggered by the 1960 Betting and Gaming Act – a watershed development that allowed betting on racing and greyhounds to take place in licensed shops around the country.

For the first time, punters did not need to be physically at a racecourse or dog track to legally place a bet. There was still an incentive for big-time punters to go racing because if they were betting in shops they had to pay tax.

But bookmakers small and large had to be on the lookout to protect themselves against betting coups in what was now “open season” for big-stakes punters. If, for example, a group of individuals could target multiple betting shops at the same time soon before the start of a race it was hard in the pre-internet age to ensure the price was cut in time.

The Yellow Sam plot of 1975 was a perfect illustration of how a meticulously organised plot could evade the best attempts of the bookies to minimise their exposure.

The 1990s: Multiple sports, multiple platforms

When restrictions were lifted on football betting to unlock a wide range of markets on individual matches, horse racing’s dominance as a sports betting medium was challenged for the first time.

At the same time, firms were opening more and more shops, allowing telephone and online accounts while accessing more and more global television feeds.

This was the decade in which odds-compilers really earned their corn for bookies like Coral, Ladbrokes and William Hill – traditional names with presence on the high-street, at the courses and, bit by bit, on rudimentary web browsers too.

Sports traders and palps

If, for example, you were a graduate with a good degree in maths or economics and you also followed rugby union religiously you could be hired specifically to draw up rugby union markets for one of the big operators.

With so much sport to bet on, and so many new avenues from which to glean useful information, this was also the time that “palps” (bookie slang for palpable errors) were at their most prevalent.

Shrewd punters could sometimes find out if an obscure tennis match or an overseas domestic football game had been rescheduled to an earlier time slot. If the bookies were unaware they could find themselves accepting a bet on an event that had already happened.

How exchanges changed the landscape

The arrival of Betfair into an increasingly cluttered market in 2000 proved a positive intervention in a number of ways, even if some small on-course bookmakers to this day rue the dawn of exchange betting.

Betfair had a huge USP: it was allowing markets to be set by individuals trading on its platforms hours and sometimes days in advance. The prices were not set by individual odds-makers using personal assessment.

Over the intervening 20 years, the exchanges have had their ups and downs but for bookmakers they provide two major positives which serve as some sort of compensation for draining them of the business they once did.

Firstly, by using the wisdom of the crowd, exchanges establish robust markets relatively quickly meaning betting companies no longer need to invest so heavily in their own odds-makers.

Secondly, the exchanges provide an easy mechanism for bookmakers to lay off worrying liabilities and can even provide early warning of a potential betting coup attempt.

What is BetConnect’s role in the market?

BetConnect is a hybrid solution that combines many of the strengths of the Betfair model – it is, after all, a peer-to-peer exchange – alongside the reassurance of big bets being matched without restrictions.

Available prices quoted are based on real-time markets provided by a wide range of online bookmakers. The platform gives bettors reassurance that they are getting the best bookie prices while layers know where to head for matched betting opportunities.

BetConnect’s single biggest advantage is its ability to fuse three disparate groups of individuals:

- Professional punters who have grown frustrated by restrictions imposed on them by the bookies

- Recreational players who enjoy backing and laying selections

- The growing community of matched betting enthusiasts

If you think you’re ready to bet on horse racing or any other sport then sign up for a BetConnect account now. BetConnect is the only exchange that lets you back selections at bookie odds with no restrictions, and lay the selections of other account-holders commission-free. Not sure how it works? Read this simple guide.